AI chipmaker Nvidia to join Dow Jones, replacing rival Intel

The addition of Nvidia to the Dow Jones Industrial Common is a notable milestone, suggesting a extra secure outlook for the AI chipmaker in its continued rise and growing prominence within the tech sector.

The synthetic intelligence chief Nvidia is ready to interchange Intel within the Dow Jones Industrial Common (DJIA), as introduced in a press launch by S&P World on 1 November.

This adjustment, taking impact earlier than buying and selling opens on 8 November, can even see Dow Inc. changed by The Sherwin-Williams Co. within the index.

The DJIA, the oldest inventory index on the planet and one in all Wall Avenue’s three main benchmarks, said that the replace goals to make sure “a extra consultant publicity to the semiconductors trade and the supplies sector, respectively”.

The Dow Jones Industrial Common tracks 30 massive publicly traded firms throughout numerous sectors. Not like indices weighted by market capitalisation, such because the S&P 500, the DJIA is price-weighted, that means firms with greater inventory costs have a larger affect, no matter their general market worth.

Nvidia’s latest 10-for-1 inventory cut up, aimed toward growing accessibility for traders, has additionally facilitated its inclusion by decreasing its affect on the index’s actions.

The addition of Nvidia to the Dow is a notable milestone, suggesting a extra secure outlook for the corporate in its continued rise. The DJIA typically consists of blue-chip corporations which are well-established, financially secure, and vital gamers inside their industries, which aligns with Nvidia’s profile. Nonetheless, the inclusion could not result in a considerable shopping for surge, as most passive funding funds give attention to broader indices, just like the S&P 500.

In the meantime, Intel, one of many world’s most famous know-how firms, offering central processing items (CPUs) for private computer systems, has been dealing with progress challenges. Lagging behind opponents equivalent to Nvidia, Broadcom, and Taiwan Semiconductor Manufacturing Co. Ltd. within the AI chip sector, Intel has seen a drastic fall in valuation, dropping over half of its market capitalisation this yr as its share value dropped to a 10-year low.

The corporate has introduced cost-cutting measures, together with employees reductions and facility closures, and has drawn curiosity from rivals who could think about buying components or all of its operations.

Nvidia Might Surpass Apple Once more in Market Valuation

Nvidia’s inclusion within the Dow additional underscores its meteoric rise in market valuation amid the AI growth.

In June, Nvidia briefly overtook Apple because the world’s Most worthy firm after securing a 20% weighting within the Expertise Choose Sector SPDR Fund (XLK) inside the S&P 500. Nvidia’s market capitalisation presently stands at $3.34tn (€3.07tn), trailing Apple by a modest $20bn, or about 6%.

Nvidia has benefitted from surging demand in AI know-how, with its shares hovering 174% year-to-date and 910% over the previous two years.

Nvidia’s distinctive inventory efficiency is supported by strong income progress, which surged by 270% over the primary two quarters of its 2025 fiscal yr.

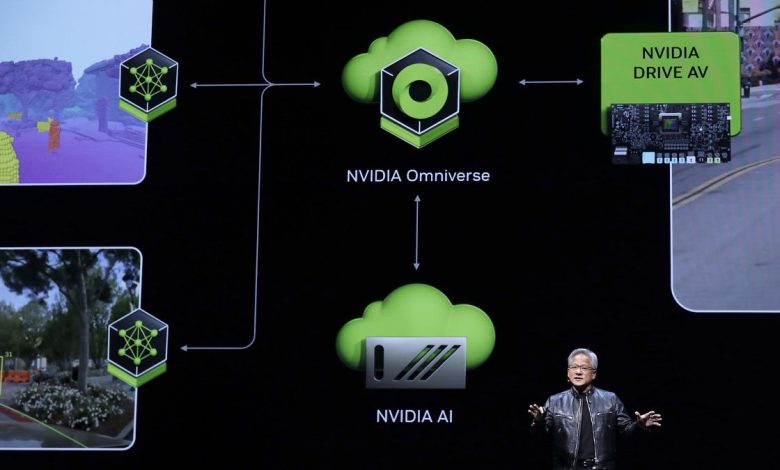

Its new Blackwell AI chips have been so extremely wanted that manufacturing capability is reportedly booked out for a full yr, in accordance with analysts from Morgan Stanley. Nvidia’s CEO, Jensen Huang, lately confirmed that Blackwell manufacturing is at full capability, describing demand as “insane”. The forthcoming fiscal third-quarter earnings report for 2025, scheduled for subsequent month, will doubtless entice shut investor scrutiny.

Conversely, Apple’s momentum slowed following its September-quarter earnings outcomes final week.

Gross sales in China have continued to say no amid intensified competitors from Chinese language rivals, and its AI capabilities, branded “Apple Intelligence”, didn’t excite traders. Apple seems to be lagging behind different tech giants within the race to capitalise on AI innovation, particularly in contrast with Nvidia’s speedy ascent.